Nonprofit Donor Receipts Best Practices

Nonprofits and cultural institutions understand the importance of maintaining their finances. Every penny earned from donations, fundraising campaigns, tickets, and gift items will go directly to achieving your cause and mission statement. And every penny counts.

Donors, too, care about how their money is being managed and handled. They’d like to know that their gratitude is being put to use in the best way possible and in the ways that they intended.

This is where donor receipts can be immensely useful in offering transparency and insights for donors. Below we’ll cover everything you need to know about nonprofit donor receipt best practices.

What are donor receipts for nonprofits?

Any receipt issued to a donor after they’ve made a donation to your organization is considered a nonprofit donor receipt. Unlike traditional payment transaction receipts, donor receipts can be issued for both monetary and non-monetary gifts, and they’re a way to notify the recipient that their donor was received by your organization.

Why do donor receipts matter?

Nonprofit donor receipts, even the non monetary ones, are important for a number of reasons. Below are a few reasons why you should be implementing donor receipts into your charitable infrastructure.

- Financial footprint

-

- Donor receipts are a convenient way to help you stay on top of your records while also providing a financial history on your donors. Donor receipts offer valuable data not just on amounts and payment trends, but also what specific donors or members are willing to give toward. This can help you stay on top of your key metrics and help you create future marketing and fundraising campaign strategies.

- Reminder of possible Incentive for major gifts to be made

-

- Federal, state, and local municipalities will often recognize and reward charitable donations, which is a huge incentive for donors to give. Donors can benefit from tax deductions, write offs, and other incentives through their philanthropy. Receipts will make it easier for donors to stay on top of these incentives, and you can remind them that their receipt can be used during tax season.

- Improve donor relations

-

- Receipts are an excellent way to show donors that their funds have been received and are being put to good use. With a robust email marketing campaign, you can accompany your receipt with information about the cause, images of what their money will go, how effective your previous years’ earnings were, and more. Donors want to see that their money is utilized effectively, and you can improve the donor relationship by showing donors how their funds are being used through the receipt message.

The receipt is essential for record-keeping and proper financing, but never lose sight of the additional opportunities it might provide in your marketing, outreach, and donor experience strategies.

When is a nonprofit donor receipt required?

A lot of ticketing and donor payment solutions, like ACME, will have automated email receipts and notifications integrated into their platforms. This means that as soon as your donors make a payment, gift, or donations, they will automatically receive a personalized email.

This is great for both the donor and your organization, and you can easily customize, personalize, and automate emails with advanced email marketing features. Emails should include a thank you, the dollar amount that the donor paid, and any other information you’d like to include in the email, including images, additional information about the donation campaign, results from last year’s campaign, and images that would compliment the donation.

With many different ways to give to a charity, there are accordingly a number of different types of receipts that you can give back to your donors. Below are some of the most common types of donor receipts you’ll have to process for your donors.

- Charitable donations, which are receipts for direct monetary donations, usually in the form of a letter or email

- In-kind receipts are receipts for non-monetary goods and services. Some but not all of these types of donations are tax-deductible, but nonprofits can always issue receipts for these, regardless of their taxability

- Stock donations are gifted to nonprofits by corporations in the form of stocks that are shares of the company. Rather than providing the dollar value of the stock, the percentage of shares is all that nonprofits should be providing in the receipt because of how difficult it is to accurately define the value of a stock or share.

- Silent auction receipts are pretty straightforward for receipts that indicate what was purchased at the auction, the amount, the name of the event, and the organization name.

- End of year receipts are some of the most important receipts you can provide. Most donations are made in November and December, and providing an annual receipt of all the donations an individual has made can remind them of all the great work they’ve done and encourage them to finish the year strong. These receipts should include a huge thank you, all the donations a donor has provided, and a reminder to end the year strong.

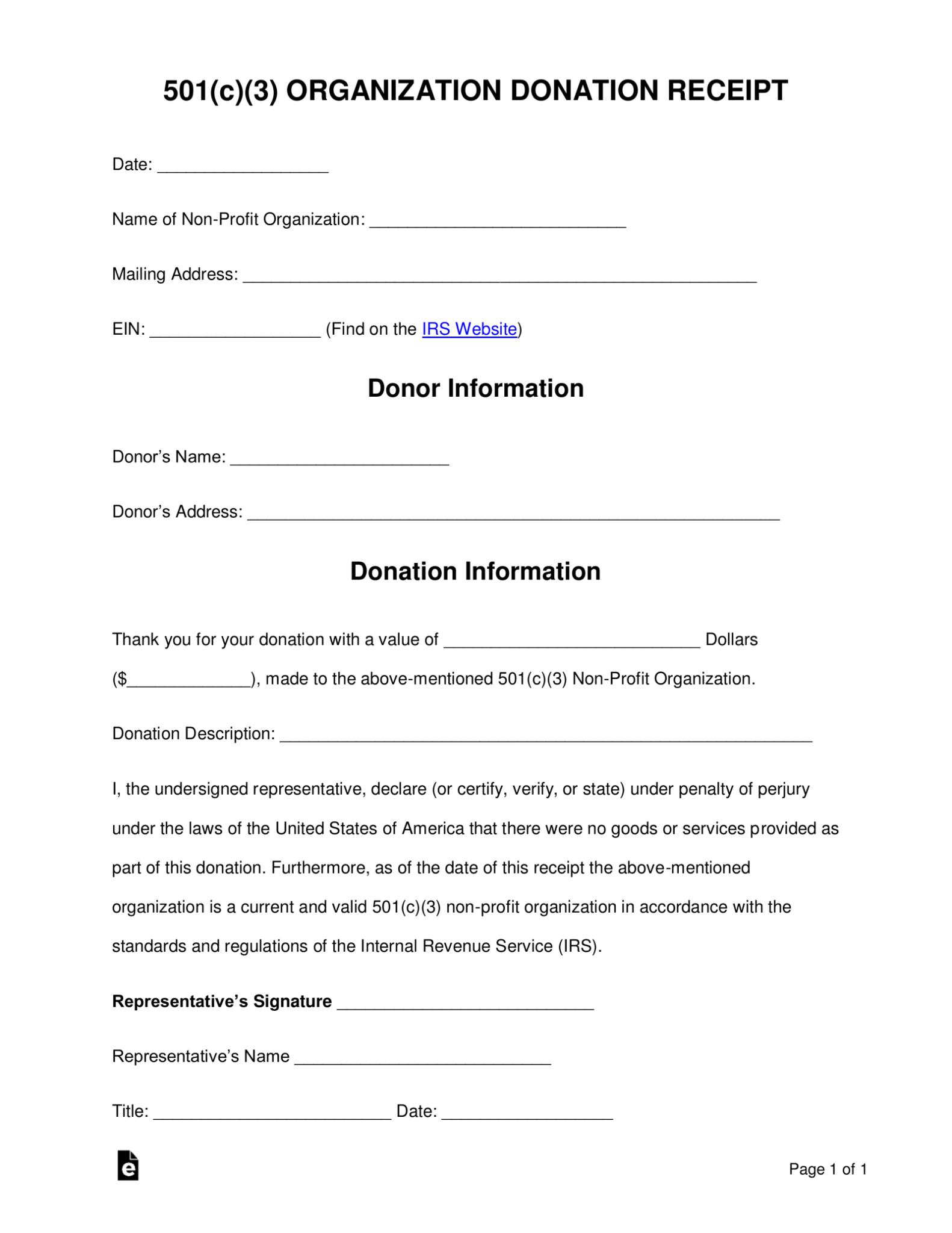

Sample donor receipt

You can access a number of free donor receipt templates online to start with. Again, a lot of advanced ticketing and donor management platforms will come with built in receipt capabilities, but for smaller nonprofits without a state-of-the-art ticketing platform, you can benefit from a free sample like the one below:

ACME Can Streamline Your Donor Receipts

ACME ticketing has a flexible cloud-based POS system that allows you to get receipts to your donors anytime, anywhere. ACME allows you to customize, personalize, and automate the process so you can reach donors, guests, and members with ease.

Improve your charity strategy with ACME’s easy-to-use donation features, like custom messaging to potential donors, confirmation email customization, and a stream-lined flow for donation-only orders, taking users directly to payments after they’ve selected their donation amount.

Click here to see how ACME can transform your donor strategy today.